Flat depreciation calculator

Domain and Range of Linear Functions. Calculate Annual Depreciation Calculated and table.

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

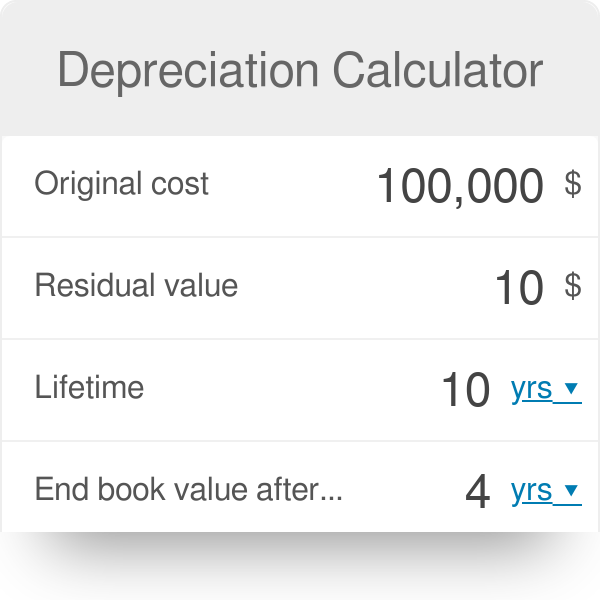

The calculator should be used as a general guide only.

. In fact the cost of your new car drops as soon as you drive it off the dealership lot. This depreciation calculator is for calculating the depreciation schedule of an asset. Flat depreciation calculator.

This depreciation calculator will determine the actual cash value of your Modified Bitumen - Flat using a replacement value and a 10-year lifespan which equates to 01 annual depreciation. Determine the cost of the asset. This is the remaining.

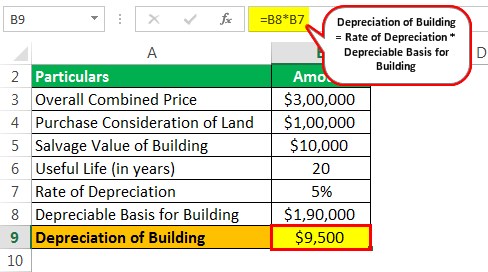

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Flat-rate methods use a calculation basis of either the recoverable cost or recoverable net book value to calculate annual depreciation. This depreciation calculator will determine the actual cash value of your Flat Built-Up using a replacement value and a 12-year lifespan which equates to 012 annual depreciation.

There are many variables which can affect an items life expectancy that should be taken into consideration. It provides a couple different methods of depreciation. Car depreciation refers to the rate at which your car loses its value from the first year you bought it.

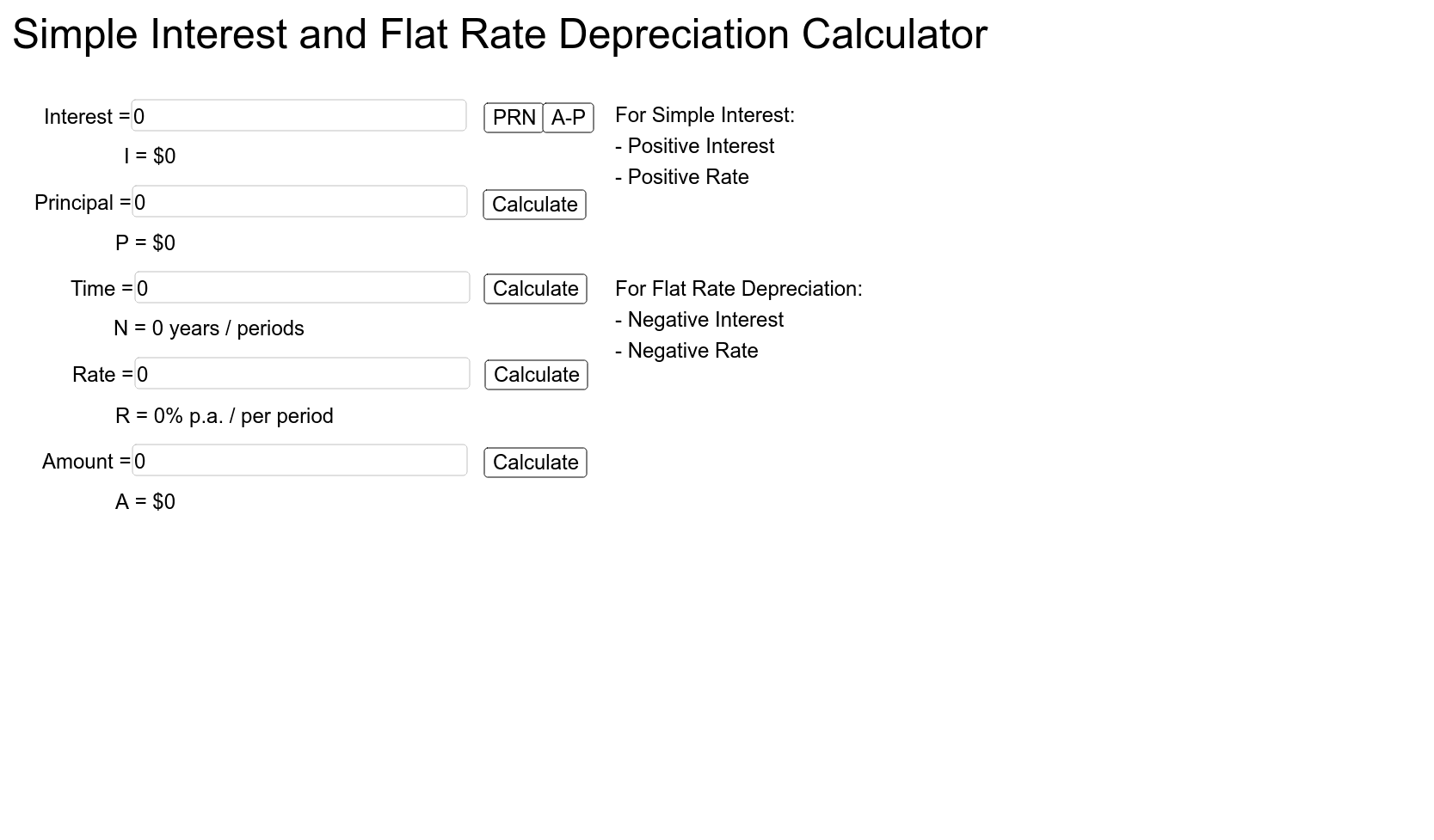

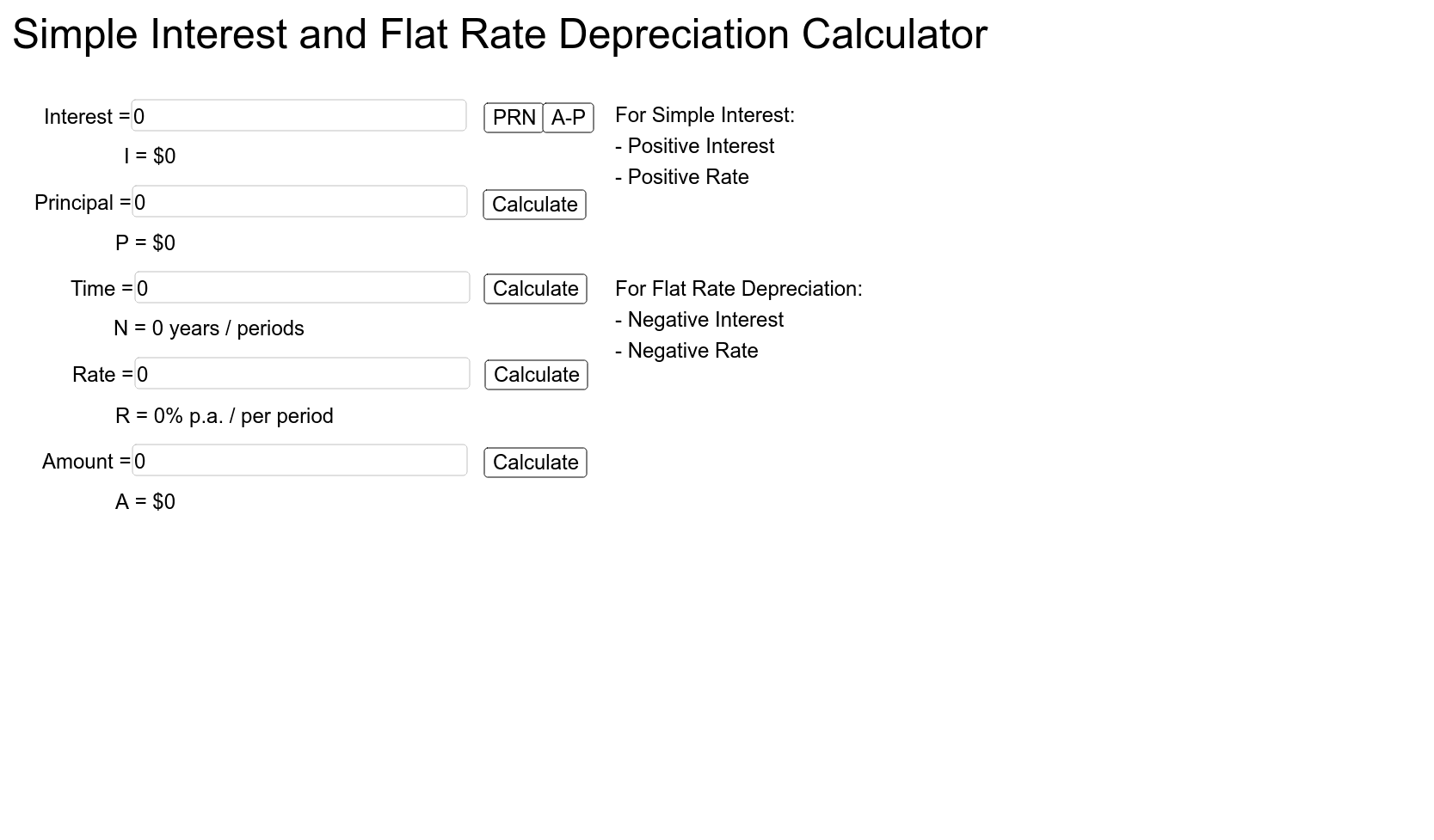

Simple Interest and Flat Rate Depreciation Calculator. The Depreciation Guide document should be used as a general guide only. The four most widely used depreciation formulaes are as listed below.

Build Your Future With a Firm that has 85 Years of Investment Experience. Percentage Declining Balance Depreciation Calculator. There are many variables which can affect an items life expectancy that should be taken into consideration.

In such cases depreciation is arrived at through the following formula. First one can choose the straight line method of. Assets depreciating under flat-rate methods with a.

How to Calculate Straight Line Depreciation. It provides a couple different methods of depreciation. Subtract the estimated salvage value of the asset from.

Flat-rate depreciation methods determine the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate. Form 1 43879 A Rekursion. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Depreciation asset cost salvage value useful life of asset. Build Your Future With a Firm that has 85 Years of Investment Experience. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the.

Number of years after construction Total useful age of the building 2060 13. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The depreciated value of the property is 1060 ie.

This depreciation calculator will determine the actual cash value of your Curling Flat Iron using a replacement value and a 10-year lifespan which equates to 01 annual depreciation. Straight Line Depreciation Method. This depreciation calculator will determine the actual cash value of your Flat.

For example if you have an asset. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. This depreciation calculator will determine the actual cash value of your Flat Built-Up using a replacement value and a 12-year lifespan which equates to 012 annual depreciation.

For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the disco See more. The straight line calculation steps are.

What Is Property Building Depreciation Rate And How To Calculate It

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator India For Asset Property Online

Straight Line Depreciation Calculator And Definition Retipster

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense

Flat Interest Rate Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator

Depreciation Of Building Definition Examples How To Calculate

How To Calculate Property Depreciation

Depreciation Calculator Definition Formula

What Is Property Building Depreciation Rate And How To Calculate It